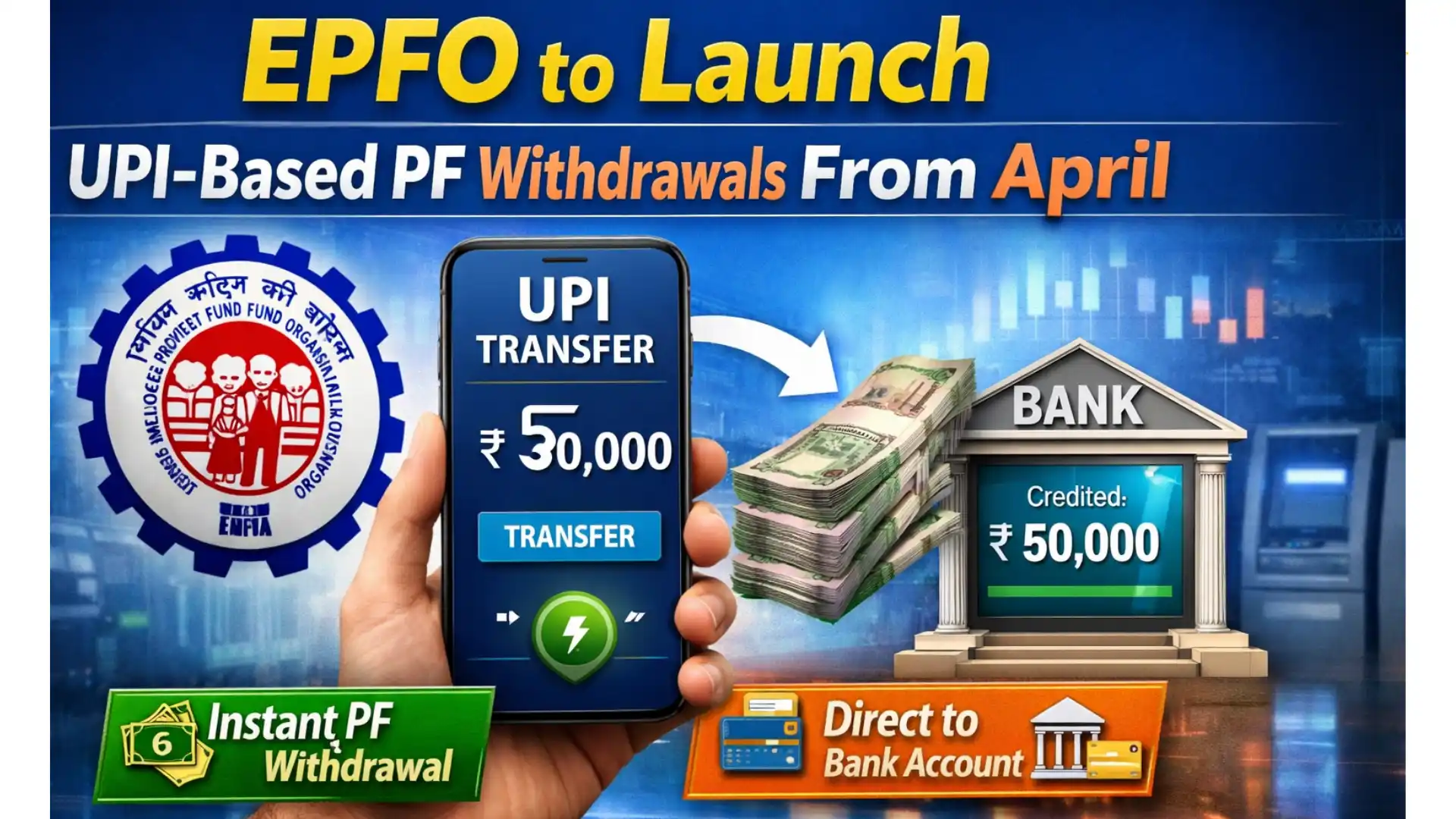

PF Withdrawal via UPI: In a major step towards digital transformation of social security services, the Employees’ Provident Fund Organisation (EPFO) is preparing to roll out a new system that will allow members to withdraw part of their provident fund directly into their bank accounts using UPI. The facility is expected to be launched from April and is likely to benefit nearly 8 crore EPFO subscribers across the country.

This initiative is part of a broader plan by the Labour Ministry to make PF withdrawals quicker, simpler, and more user-friendly. At present, members need to submit formal claims and wait for approval, which often takes several days. The new UPI-based system aims to significantly reduce this waiting period.

How the New UPI-Based PF Withdrawal Will Work

Under the proposed framework, EPFO members will be able to see the portion of their PF balance that is eligible for withdrawal. While a certain amount of the corpus will remain locked as per existing rules, the withdrawable portion can be transferred instantly using the Unified Payments Interface (UPI).

Members will authenticate the transaction using their UPI PIN, after which the amount will be credited directly to their linked bank account. Once received, the funds can be used freely for online payments, transfers, or cash withdrawals via ATM.

Comparison: Existing Process vs UPI-Based System

| Aspect | Current PF Withdrawal Process | Upcoming UPI-Based System |

|---|---|---|

| Claim submission | Required | Not required |

| Processing time | Several days | Near-instant |

| Authentication | EPFO approval | UPI PIN |

| User convenience | Moderate | High |

| Mode of transfer | Bank settlement | UPI payment gateway |

Auto-Settlement Limit Already Enhanced

Ahead of this change, EPFO has already increased the auto-settlement claim limit from ₹1 lakh to ₹5 lakh. Under this system, eligible claims related to medical needs, education, marriage, or housing are settled electronically within three working days, without manual intervention.

Why This Change Matters

EPFO handles more than 5 crore claims every year, most of them related to PF withdrawals. The new UPI-enabled withdrawal mechanism is expected to reduce administrative burden, speed up settlements, and improve overall service delivery. While EPFO cannot allow unrestricted direct withdrawals due to the absence of a banking licence, the government is working to upgrade its systems to offer bank-like convenience with proper safeguards.

The introduction of UPI-based PF withdrawals is set to be a game-changer for salaried employees, offering faster access to their savings during times of need. Once implemented, it will mark a significant shift towards instant, digital-first social security services in India.

Yogesh Kolhe is a market and business news author with a focus on the automobile sector and gold and silver price movements, offering readers practical insights into industry and market trends.