Gold rate today 31 January 2026 turned historic for Indian markets as gold prices witnessed a sharp correction after a powerful rally earlier this week. Both futures and retail markets saw heavy selling, with prices falling by nearly 12% in a single day. The sudden drop came as investors booked profits and the US dollar strengthened sharply ahead of the Union Budget 2026.

Market participants said the correction was overdue after gold touched record highs in recent sessions.

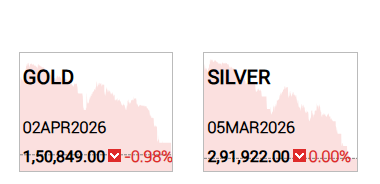

MCX Gold and Silver See Heavy Fall

On the futures side, the Multi Commodity Exchange of India (MCX) recorded one of its biggest single-day declines in recent times.

- MCX Gold (February 2026 futures) settled near ₹1,49,075 per 10 grams, down by more than ₹20,000 from the previous close.

- MCX Silver (March 2026 futures) also slipped sharply and was trading around ₹3,94,900 per kg.

The steep fall erased a large part of the gains made during January’s strong rally.

Gold Rate Today 31 January 2026: City-wise Prices

Retail gold prices across major cities also dropped sharply. These rates include local levies but exclude 3% GST and making charges.

| City | 24K Gold (10g) | 22K Gold (10g) |

|---|---|---|

| Mumbai | ₹1,50,690 | ₹1,38,133 |

| Delhi | ₹1,50,430 | ₹1,37,894 |

| Bengaluru | ₹1,50,810 | ₹1,38,243 |

| Chennai | ₹1,51,130 | ₹1,38,536 |

| Kolkata | ₹1,50,490 | ₹1,37,949 |

| Hyderabad | ₹1,50,930 | ₹1,38,353 |

| Ahmedabad | ₹1,50,890 | ₹1,38,316 |

Just a day earlier, 24K gold was trading between ₹1.69 lakh and ₹1.75 lakh, highlighting the scale of the correction.

Why Did Gold Prices Fall So Sharply?

There were three main reasons behind the fall in gold rate today 31 January 2026.

First, the US dollar strengthened after Kevin Warsh was nominated as the new US Fed Chair, reducing demand for gold globally.

Second, investors rushed to book profits after gold hit record international levels near $5,600 per ounce earlier this week.

Third, markets turned cautious ahead of the Union Budget 2026, as traders expect possible changes in import duties.

With volatility likely to remain high, investors are closely watching Budget announcements for the next move in gold prices.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Gold rates and MCX prices are subject to market volatility. Readers should consult with a qualified professional before making any investment decisions.

Sources & References

- https://www.livemint.com/market/commodities/gold-silver-rate-today-live-updates-mcx-gold-mcx-silver-price-after-crash-why-are-prices-falling-donald-trump-31-jan-11769849536419.html#:~:text=Gold%20Rate%20Today%20LIVE%3A%20How,according%20to%20the%20official%20data.

- https://www.india.com/business/gold-price-silver-rates-us-dollar-mcx-gold-kiolkata-mumbai-chennai-bengaluru-federal-reserve-chair-indian-currency-diamond-economy-budget-2026-nirmala-sitharaman-stock-market-8287622