Gold rate today 1 February 2026 is witnessing sharp volatility in the Indian market, with prices correcting heavily from the record highs seen earlier this week. Both futures and retail markets are under pressure as investors rush to book profits ahead of the much-awaited Union Budget 2026 announcement.

Market participants say the sharp fall reflects nervousness and uncertainty, as traders wait to see if the government announces any changes related to import duty or taxes on precious metals.

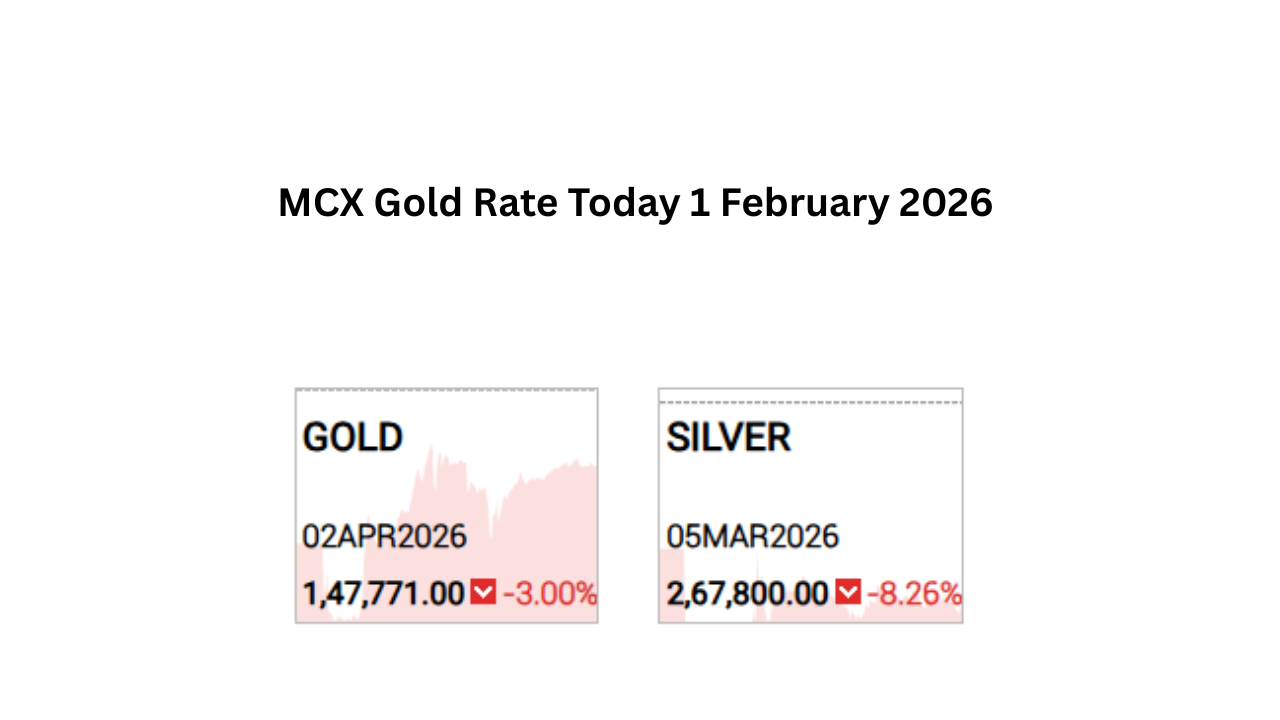

MCX Gold Rate Today 1 February 2026

On the futures market, prices on the Multi Commodity Exchange of India (MCX) slipped sharply during morning trade.

- MCX Gold (April 2026 futures) was trading around ₹1,47,771 per 10 grams, down nearly 6%, and even touched the lower circuit during the session.

- MCX Silver (March 2026 futures) fell harder and hit the 6% lower circuit, trading near ₹2,67,800 per kg.

This comes after gold had surged past ₹1.80 lakh per 10 grams earlier in the week, triggering aggressive profit booking.

Gold Rate Today 1 February 2026: City-wise Gold Prices

Retail gold prices followed the MCX trend and declined across major Indian cities. Prices below are indicative and may vary slightly due to local taxes and making charges.

| City | 24K Gold (10g) | 22K Gold (10g) |

|---|---|---|

| Mumbai | ₹1,60,580 | ₹1,47,200 |

| Delhi | ₹1,60,730 | ₹1,47,350 |

| Chennai | ₹1,62,550 | ₹1,49,000 |

| Bengaluru | ₹1,60,580 | ₹1,47,200 |

| Kolkata | ₹1,60,580 | ₹1,47,200 |

| Hyderabad | ₹1,60,580 | ₹1,47,200 |

| Ahmedabad | ₹1,60,630 | ₹1,47,250 |

| Pune | ₹1,60,580 | ₹1,47,200 |

Why Are Gold Prices Falling Today?

There are three key reasons behind the fall in gold rate today 1 February 2026.

First, investors are booking profits after the recent sharp rally.

Second, markets are cautious ahead of the Budget, as even small policy changes can impact gold demand.

Third, technical indicators suggest immediate support for MCX gold lies between ₹1,35,000 and ₹1,40,000.

With the Budget speech due later today, gold prices are expected to remain volatile. Buyers and investors are advised to track live rates closely before taking any decision.

Also Read: Dhurandhar Box Office Collection Day 58: Historic Film Nears End of Theatrical Run

Disclaimer: This information is for general purposes only and does not constitute professional financial, medical, or legal advice. Use at your own risk.