What are Smart Cashtags?

Smart Cashtags upgrade the familiar ticker symbol system by allowing users to tag specific financial assets or smart contracts, rather than relying on symbols that may represent multiple instruments. This is particularly relevant in crypto markets, where overlapping tickers are common.

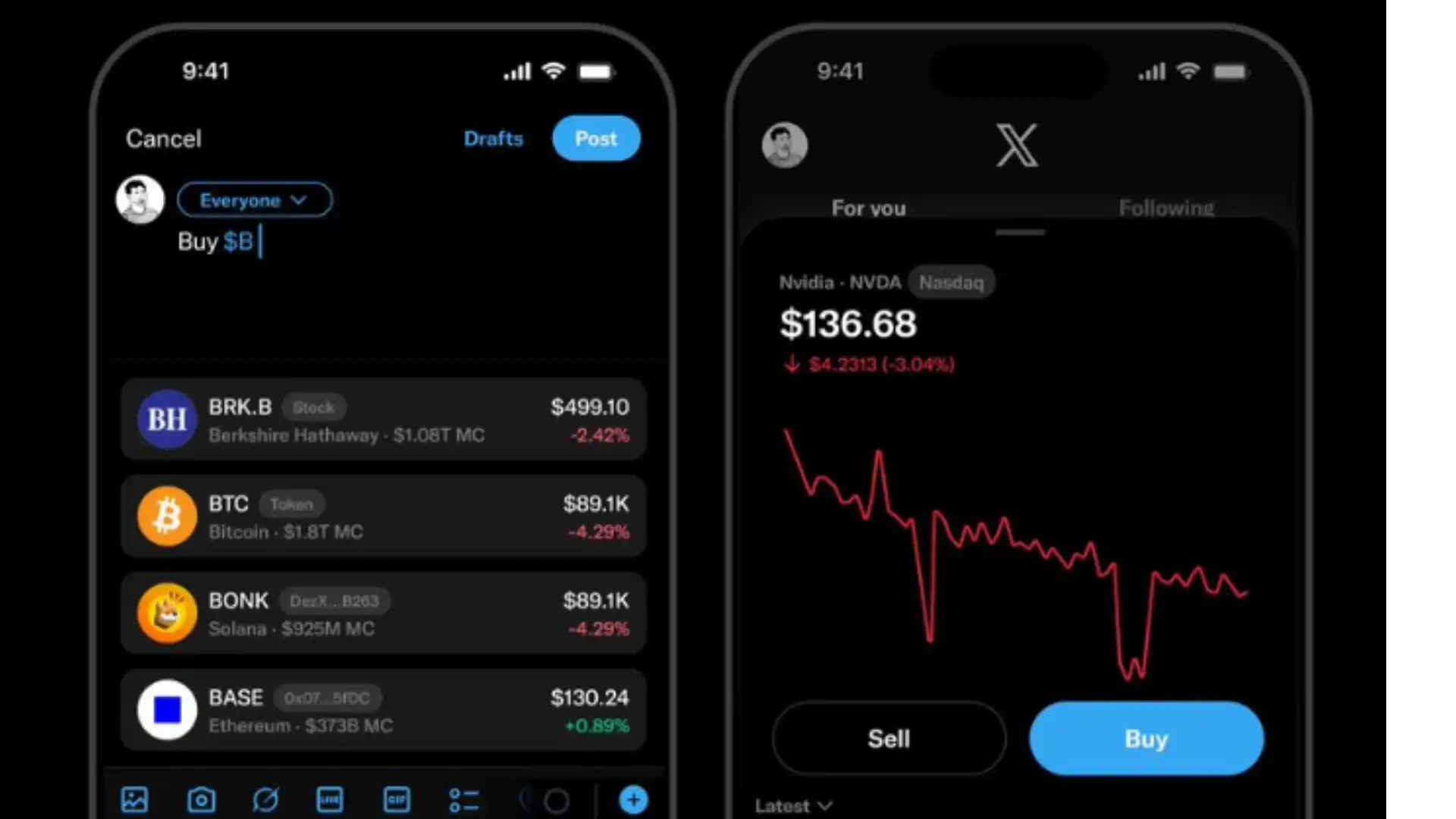

When users tap a Smart Cashtag, they will see:

- Near real-time price data

- Interactive charts

- A dedicated feed of posts mentioning that asset

All of this content appears without leaving X, reinforcing the company’s goal of keeping users engaged inside its ecosystem.

Trading features spark speculation

Interest intensified after product mockups shared by Bier showed buy and sell buttons attached to certain assets. While X has not confirmed any trading functionality, the visuals triggered widespread speculation across the crypto and fintech communities.

Some analysts believe X could partner with established platforms such as Coinbase or traditional brokerages, positioning itself as the discovery and discussion layer while licensed firms handle transactions. Others suggest owner Elon Musk may push for an internal solution, especially given the recent launch of X Money, the platform’s payments service introduced in early 2025 in partnership with Visa.

Also Read: India PSLV rocket fails again, 16 satellites lost in second setback in 8 months

Built for blockchain speed

According to Bier, the API behind Smart Cashtags will be “almost real-time for anything minted on chain,” signaling strong support for newly launched tokens and decentralized finance projects. This blockchain-first approach caught the attention of leaders from Solana, who publicly invited X to explore Solana-based infrastructure.

Bier, who serves as an adviser to Solana, joined X in mid-2025, adding further credibility to the platform’s crypto ambitions.

A broader financial vision — amid regulation

Smart Cashtags align with X’s wider push to position itself as financial infrastructure. Bier has previously noted that massive amounts of capital move based on information shared on social platforms, underscoring why X sees finance as a natural extension of its influence.

However, the expansion comes at a sensitive time. X is facing increased regulatory scrutiny in Europe, including a €120 million fine issued in December 2025 under the Digital Services Act related to verification practices, ad transparency, and researcher access.

Former CEO Linda Yaccarino had also hinted at in-app investing and trading plans in mid-2025 before stepping down, leaving open questions about how aggressively X will pursue monetization through financial tools.

What it means for users and markets

If successful, Smart Cashtags could transform how investors and traders discover, discuss, and monitor assets in real time — blending social sentiment with live market data in a single feed. Whether X stops at information or moves into execution remains unclear, but the February rollout will be a closely watched moment for both tech and finance industries.

For now, Smart Cashtags signal one thing clearly: X wants to be more than a social network — it wants to be part of how markets move.